Small Business Liability Insurance Coverage Explained delves into the intricacies of this crucial aspect for businesses, shedding light on its significance and implications. The following paragraphs will unravel the complexities of small business liability insurance in a clear and engaging manner.

As we embark on this informative journey, we will explore the various facets of small business liability insurance to equip you with the knowledge needed to safeguard your business effectively.

Understanding Small Business Liability Insurance

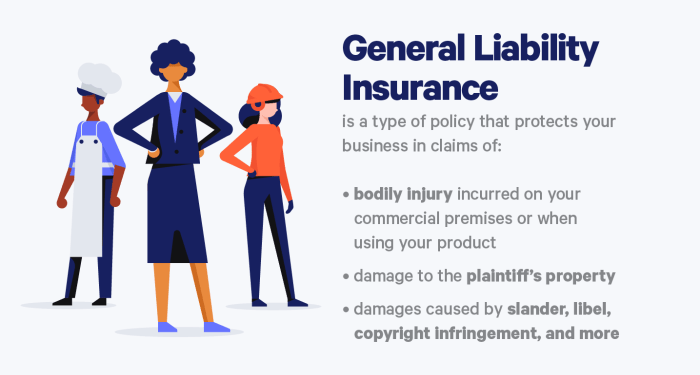

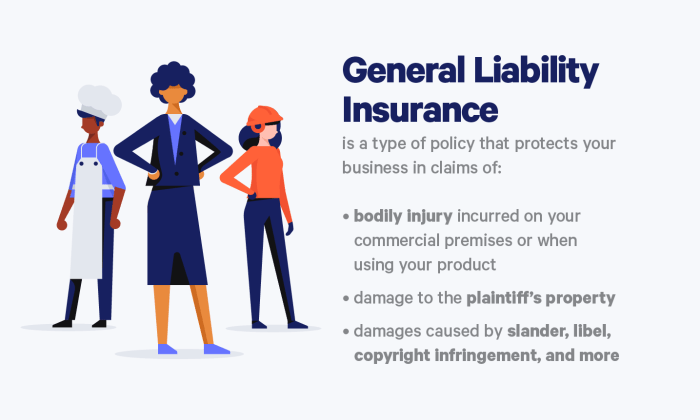

Small business liability insurance is a type of insurance coverage that helps protect businesses from financial losses resulting from lawsuits or claims filed against them by third parties. This insurance typically covers legal costs, settlements, and judgments up to the policy limits.Having small business liability insurance is crucial for protecting your business assets and ensuring financial stability. Without this coverage, a single lawsuit or liability claim could potentially bankrupt your business. It provides peace of mind and allows you to focus on growing your business without the constant worry of legal liabilities.Importance of Small Business Liability Insurance

- Protects your business assets: In the event of a lawsuit, your personal assets and the assets of your business are protected from seizure to cover legal costs or settlements.

- Legal compliance: Many clients or business partners may require you to have liability insurance before entering into contracts or agreements.

- Professional reputation: Having insurance demonstrates to clients and customers that you are a responsible business owner who is prepared for unexpected events.

Scenarios Where Small Business Liability Insurance is Crucial

- A customer slips and falls in your store, resulting in a serious injury and a potential lawsuit for medical expenses.

- An employee makes a mistake that causes financial harm to a client, leading to a lawsuit for negligence.

- Your product causes harm or damage to a customer, resulting in a product liability claim.

Types of Small Business Liability Insurance

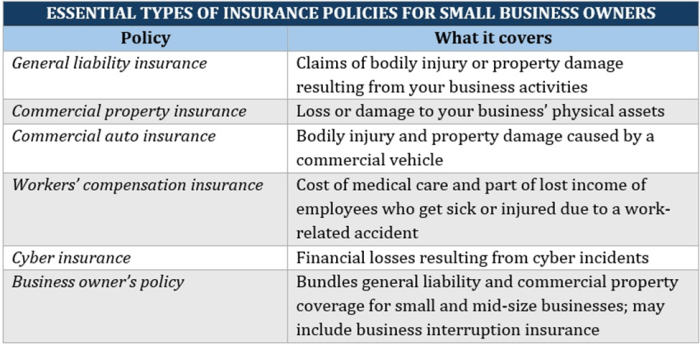

In addition to general liability insurance, there are several other types of liability insurance that small businesses may need to protect themselves from various risks.

In addition to general liability insurance, there are several other types of liability insurance that small businesses may need to protect themselves from various risks.Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims related to professional services or advice that result in financial harm to a client. This type of insurance is crucial for businesses that provide specialized services or expertise, such as consultants, lawyers, accountants, and healthcare professionals.Product Liability Insurance

Product liability insurance protects businesses from claims related to damages or injuries caused by products they manufacture, distribute, or sell. This type of insurance is essential for businesses in the manufacturing, retail, and distribution industries. For example, a toy manufacturer would need product liability insurance to cover any injuries caused by their products.Cyber Liability Insurance

Cyber liability insurance covers businesses in the event of a data breach or cyber-attack that compromises sensitive customer information. With the increasing threat of cybercrimes, businesses that collect and store customer data online, such as e-commerce websites or software companies, should consider cyber liability insurance to protect themselves from potential financial losses and legal liabilities.Coverage Limits and Exclusions

When it comes to small business liability insurance, understanding coverage limits and exclusions is crucial for ensuring adequate protection. Coverage limits determine the maximum amount an insurance policy will pay out for a covered claim, while exclusions are specific situations or types of damage that are not covered by the policy.

When it comes to small business liability insurance, understanding coverage limits and exclusions is crucial for ensuring adequate protection. Coverage limits determine the maximum amount an insurance policy will pay out for a covered claim, while exclusions are specific situations or types of damage that are not covered by the policy.Coverage Limits

- Insurance policies have specific limits on how much they will pay out for different types of claims, such as bodily injury, property damage, or legal expenses.

- It is important for small businesses to carefully review their coverage limits to ensure they have adequate protection in case of a claim.

- Higher coverage limits typically result in higher premiums, so businesses need to balance the level of coverage they need with the cost of the insurance.

Exclusions

- Common exclusions in small business liability insurance policies may include intentional acts, professional errors, pollution, and certain types of lawsuits.

- It is essential for small business owners to understand these exclusions and consider additional coverage options if needed to fill any gaps in protection.

- Reading the policy carefully and consulting with an insurance agent can help businesses identify any exclusions that may apply to their specific industry or operations.

Determining Appropriate Coverage Limits

- Small businesses can determine the appropriate coverage limits by assessing their risks, assets, and potential liabilities.

- Factors such as the type of business, number of employees, annual revenue, and industry regulations can all impact the level of coverage needed.

- Working with an experienced insurance agent or broker can help small businesses tailor their coverage to meet their unique needs and ensure they are adequately protected.

Cost Factors and Saving Tips

When it comes to small business liability insurance, the cost can vary depending on several factors. Understanding these cost factors and knowing how to save money on premiums can help small businesses make informed decisions. Here are some key points to consider:Factors Influencing Cost

- The type of business: Certain industries are considered riskier than others, leading to higher premiums.

- Business size and revenue: Larger businesses with higher revenue may pay more for coverage.

- Claims history: A history of frequent claims can increase insurance costs.

- Location: Businesses in high-risk areas may face higher premiums.

Saving Tips

- Bundle policies: Consider combining multiple insurance policies with the same provider for potential discounts.

- Review coverage limits: Ensure you have adequate coverage without overpaying for unnecessary protection.

- Implement risk management strategies: Taking steps to reduce risks can lead to lower premiums.

- Shop around: Compare quotes from different insurance providers to find the best rates.

Comparing Insurance Providers

| Insurance Company | Pricing Structure |

|---|---|

| Company A | Offers competitive rates based on business size and industry. |

| Company B | Provides customizable plans with flexible payment options. |

| Company C | Specializes in small business coverage with tailored pricing. |

Legal Requirements and Compliance

In the realm of small business liability insurance, there are certain legal requirements that businesses need to adhere to in order to operate within the bounds of the law. Ensuring compliance with these regulations is crucial to avoid potential legal consequences.State and Federal Legal Requirements

- State laws: Each state may have different regulations regarding the types and coverage limits of liability insurance that small businesses are required to carry. It is essential for small business owners to be aware of and comply with the specific laws in their state.

- Federal regulations: In some industries, federal laws may mandate certain types of liability insurance to protect against specific risks. Businesses operating in these industries must meet federal requirements in addition to state laws.

Ensuring Compliance

- Consult with legal professionals: Small business owners can seek guidance from legal experts specializing in insurance law to ensure compliance with state and federal regulations.

- Regularly review policies: It is important for businesses to review their liability insurance policies periodically to confirm that they meet the current legal requirements.

- Documentation and record-keeping: Maintaining accurate records of insurance coverage and policy details can help demonstrate compliance in case of audits or legal issues.

Legal Consequences of Non-Compliance

- Fines and penalties: Failure to comply with legal requirements for liability insurance can result in fines imposed by regulatory authorities.

- Lawsuits and financial loss: Without adequate liability insurance coverage, small businesses may face lawsuits from third parties for damages or injuries, leading to substantial financial losses.

- Business closure: In extreme cases, non-compliance with legal requirements related to liability insurance could lead to business closure or suspension of operations.

Outcome Summary

In conclusion, Small Business Liability Insurance Coverage Explained serves as a valuable resource for entrepreneurs and small business owners, offering insights and guidance on navigating the realm of liability insurance with confidence. By understanding the nuances of coverage and the importance of compliance, businesses can protect themselves from unforeseen risks and thrive in today's competitive landscape.

Question Bank

What does small business liability insurance cover?

Small business liability insurance typically covers legal costs, damages, and medical expenses in case of lawsuits related to third-party injuries or property damage.

How can small businesses determine the appropriate coverage limits for liability insurance?

Small businesses should assess their risks, industry standards, and potential liabilities to determine suitable coverage limits. Consulting with an insurance agent can also help in this process.

Are there any common exclusions in small business liability insurance?

Some common exclusions include intentional acts, employee injuries covered by workers' compensation, and professional errors not related to negligence.

Can small businesses save money on liability insurance premiums?

Yes, small businesses can save money by bundling policies, implementing risk management practices, choosing higher deductibles, and comparing quotes from different insurance providers.